|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Cheapest Way to Refinance Your Home: A Comprehensive GuideRefinancing your home can be a smart financial move, especially when you're looking to lower your monthly mortgage payments or take advantage of better interest rates. However, finding the cheapest way to refinance can be tricky. In this guide, we'll explore strategies to ensure you're getting the best deal possible. Understanding Refinancing BasicsWhat is Refinancing?Refinancing involves replacing your existing mortgage with a new one, ideally with better terms. This can help reduce your monthly payments or the total amount of interest paid over the life of the loan. Why Refinance?

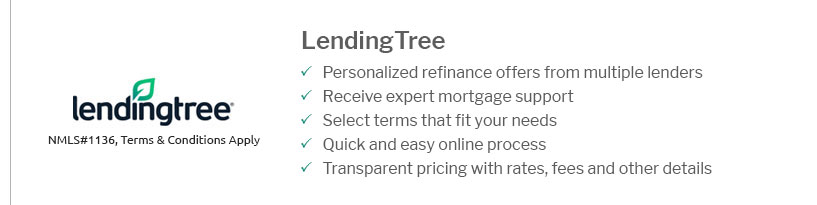

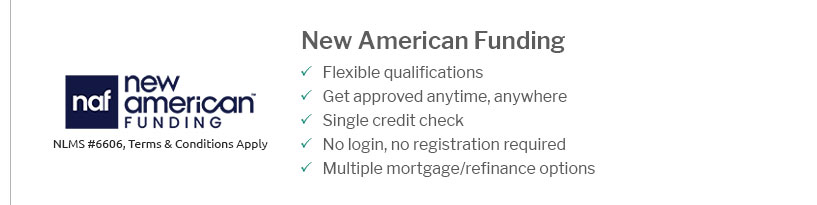

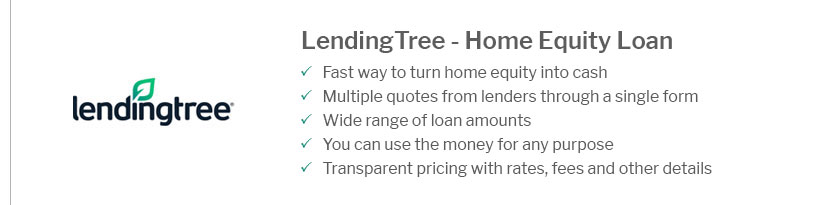

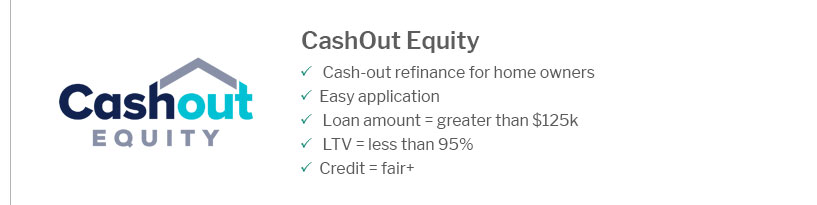

Strategies for the Cheapest RefinancingShop AroundOne of the most effective ways to ensure you're getting the best deal is to compare offers from multiple lenders. Consider checking refinance rates columbus ohio for competitive rates. Improve Your Credit ScoreA higher credit score often translates to better interest rates. Paying down debts and correcting errors on your credit report can improve your score. Consider Loan CostsBe aware of closing costs, which can sometimes negate the benefits of a lower interest rate. Negotiate these fees with your lender for a more affordable refinance. Steps to Refinance

Frequently Asked QuestionsHow often can you refinance your home?There's no legal limit to how often you can refinance, but lenders may have their own restrictions. Consider the costs and benefits before proceeding. What are typical closing costs for refinancing?Closing costs typically range from 2% to 5% of the loan amount. These may include appraisal fees, title insurance, and application fees. For those in metropolitan areas, checking specific rates can be beneficial. For instance, consider refinance rates today nyc to stay informed on the latest offerings in your region. Ultimately, the cheapest way to refinance your home involves careful consideration of your financial situation, diligent research, and negotiation. By following these strategies, you can potentially save thousands over the life of your loan. https://www.usamortgage.com/the-ultimate-guide-to-refinancing-a-home/

That way, you don't have to spend as much time looking to compare refinance rates. Recent experience demonstrates that lowering your rate by even .75% may make ... https://www.bankrate.com/mortgages/get-the-best-refinance-rate/

Key takeaways - Refinancing your mortgage makes sense if you can reduce the interest rate by one-half to three-quarters of a percentage point. https://www.nerdwallet.com/article/mortgages/ways-get-lowest-mortgage-refinance-rate

To earn the best mortgage refinance rates, build your credit score, shorten your loan term, resist a cash-out refi and get multiple interest ...

|

|---|